Bank Rate Comparisons & Money Transfer Services

Sending Money Abroad

Save money when transferring funds overseas with the best UK pound, euro and US dollar deals and exchange rates for international bank to bank money transfers.

Lightning Fast Transfers

The speed and efficiency of a currency transfer service is an essential tool for today’s fast-paced world, with instant bank to bank money transfers for major currencies.

Multi Currency Services

Choose a currency exchange specialist company to send money in GBP EUR USD AED CAD and many other international currencies to or from a UK or overseas bank account.

Unbeatable Exchange Rates

A specialist broker can offer the very best exchange rates and by keeping their margin rates low, currency brokers can beat the banks by several percentage points.

BRITISH BANKS – UK POUND GBP EXCHANGE RATES

| UK Bank Exchange Rates | GBP to EUR | GBP to USD | GBP to AED | TrustScore (Trustpilot) | More Details |

|---|---|---|---|---|---|

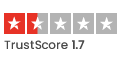

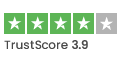

| Barclays Bank | €1.11 | $1.292 | AED4.744 |  |  |

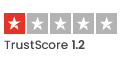

| Cater Allen Bank | €1.107 | $1.288 | AED4.729 |  |  |

| Clydesdale Bank | €1.127 | $1.31 | AED4.813 |  |  |

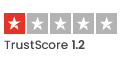

| CO-OP Bank | €1.106 | $1.286 | AED4.724 |  |  |

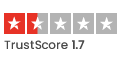

| First Direct | €1.098 | $1.277 | AED4.69 |  |  |

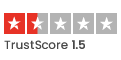

| Halifax Bank | €1.114 | $1.296 | AED4.759 |  |  |

| HSBC | €1.108 | $1.289 | AED4.734 |  |  |

| Lloyds Bank | €1.098 | $1.277 | AED4.69 |  |  |

| Metro Bank | €1.098 | $1.277 | AED4.69 |  |  |

| Monzo Bank | €1.138 | $1.324 | AED4.862 |  |  |

| M&S Bank | €1.098 | $1.277 | AED4.69 |  |  |

| Nationwide | €1.127 | $1.31 | AED4.813 |  |  |

| NatWest Bank | €1.102 | $1.282 | AED4.709 |  |  |

| RBS | €1.099 | $1.278 | AED4.695 |  |  |

| Santander Bank | €1.101 | $1.281 | AED4.704 |  |  |

| Standard Chartered Bank | €1.098 | $1.277 | AED4.69 |  |  |

| Starling Bank | €1.144 | $1.331 | AED4.887 |  |  |

| TSB Bank | €1.098 | $1.277 | AED4.69 |  |  |

| Yorkshire Bank | €1.127 | $1.31 | AED4.813 |  |  |

Money transfer exchange rates are calculated and updated hourly (Monday to Friday) from 08:00 – 16:00

International Bank Money Transfers

Transfer Supermarket compares a selection of the very best currency exchange companies who assist individuals and businesses with their international bank money transfer requirements.

We have helped thousands of people save money by comparing money transfer companies offering international payment solutions, where you can beat bank foreign exchange rates when sending money overseas.

Send Money Abroad – UK Pound, Euro & More..

If you need to arrange a money transfer abroad then you should consider that using your local bank to make your transfer will cost significantly more than using a private currency exchange company.

Sending money abroad with a private currency exchange company is very easy and in most cases the money will arrive at your designated bank account either same day or next day.

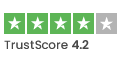

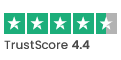

Popular currency exchange specialist companies including Currencies Direct or TorFX can offer big discounts when you transfer money from the euro, UK pound, US dollar and many other major currencies to a bank abroad.

You do not have to live in the UK to sign up, as these specialist currency exchange companies offer global customer services to their clientbase.

Transfer Supermarket Rate Comparisons

With volatile currency market exchange rates, together with excessive fees charged by banks, more and more people are choosing to transfer money abroad using a specialist currency exchange company.

These companies often offer lower fees and more competitive exchange rates compared to traditional banks, making it a more cost-effective option for those looking to send money internationally.

Currency Exchange & Personal Brokers

But it’s not only about saving money, as you’re unlikely to receive the same personal service at your bank as you would from a personal broker, who is familiar with your needs and requirements.

All major currency exchange companies use personal brokers to assist clients with their international money transfers. Additionally, these currency exchange companies usually provide a faster and more efficient service.

All foreign currency exchange rate comparisons displayed on our website are indicative and exchange rate margins will vary dependent on individual requirements.

International currency markets move throughout the day, and margins applied by foreign exchange companies will vary.